YOU NEED A BUDGET VS MINT SOFTWARE

Mint’s budgeting software is also easy to use or visually appealing. Quicken offers a robust budgeting tool that has greatly benefited from recent improvements. You know where your money is going and can manage your finances well with either one.

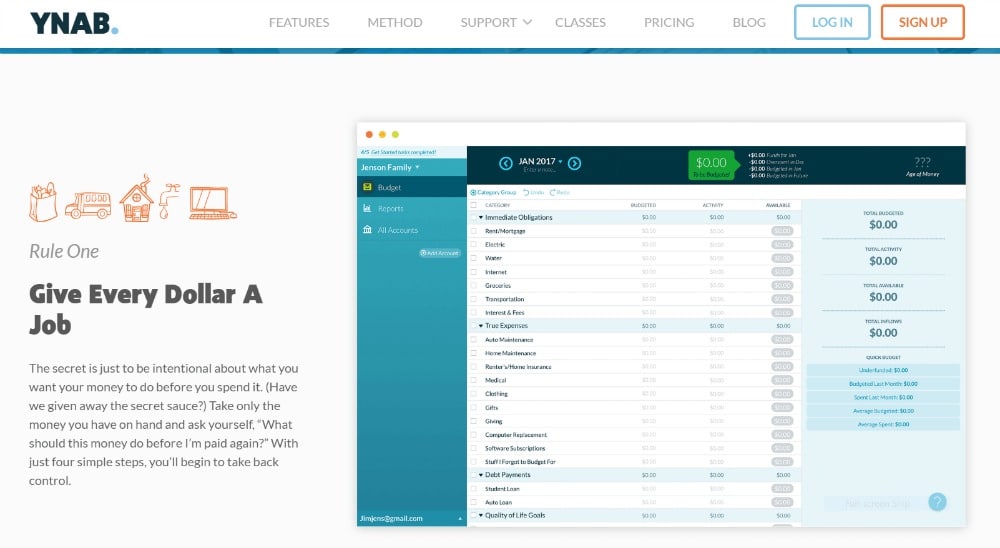

The Inspector – This feature allows you to see summary details about your budget, as well as provide quick options.Data Stored Locally – Quicken keeps your data on your own computer, so you don’t need to worry about it being unsecured in the cloud.Think of this as the online version of balancing your checkbook. Reconcile Bank Statements – Quicken allows you to check your recorded transactions against your current bank statement.Weekly Email Summaries – Find out what’s happened in the past week with your finances.Credit Report Monitoring – Mint and Quicken allow you to monitor your credit score.Mobile App – Both Quicken and Mint offer mobile support via Apple iOS or Google Android.Multi-Device Capability – Changes made to your account on any device (smartphone, desktop, tablet, laptop) automatically carry over to other devices you’re using.Direct Import/Synchronization – Both software platforms allow you to link your accounts (bank, credit cards, loans, etc.) and import transactions automatically, synchronizing your entire financial picture in one place.Budgeting – Quicken, and mint both provides a program that lets you know exactly where you are spending money in an easy to understand, graphical format.Both also provide you with access to your credit score, as well as regular email or text updates, keeping you informed of the latest developments and trends in your finances. You can set up either account on your laptop, but also access it from your smartphone or other devices. This enables you to synchronize your entire financial life on one platform. They do this by enabling you to link your various financial accounts–bank accounts, loans, credit cards, investment accounts, etc.–and automatically importing transactions. Each provides budgeting, enabling you to know how and where your money is being spent. The basic features of both platforms are very similar. And perhaps the biggest difference between the two is that when Quicken is a paid service or Mint is completely free. When they both are similar apps, each has its own specializations. Quicken and Mint are two of the budgeting software systems available. Mint also offers well-developed mobile apps, so you can easily check your spending on the visit. The software was acquired by Intuit in 2009 and today it features expense tracking, investment tracking, budgeting, planning, and more. Mint is a cloud-based, It is easy to use finance tool that’s been around since 2007. Fix all your accounting software errors & problems.

Get your accounting work done by experienced accountants.

0 kommentar(er)

0 kommentar(er)